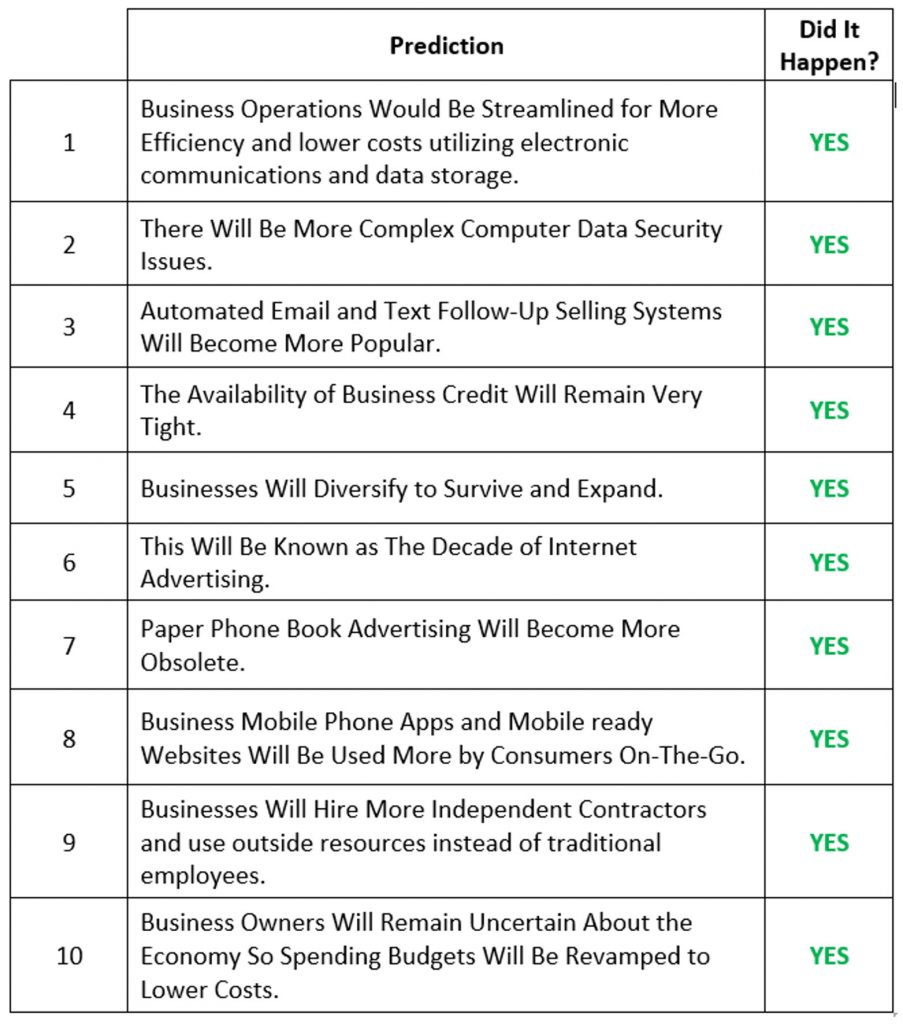

Business operations have changed dramatically since I last published my predictions back in 2013. But before I get into my predictions for the 2020 decade, let’s review and see how accurate the predictions were that I made for the last decade.

Business Cash Flow Management Predictions for 2020 and beyond

1 – Business operations will continue to be streamlined for more efficiency.

With the onset of the 2020 COVID-19 pandemic and business going on shutdown and consumers receiving stay-at-home orders, the face of business was changed dramatically. Business owners who run home-based businesses were the operational winners, having to change little to nothing about the way they operated. Businesses who are service based whose employees who could work remotely or who already worked from home stayed in fairly operating decent shape. Brick and mortar retail stores, and manufacturers deemed “non-essential” were hurt the worst.

The constant technological advance of computers, cell phones and the Internet, faster communications at lower costs will continue to become even more important to increase efficiency and production with less chance of error. This will result in increased electronic communications systems being used to keep productivity at a high level and the cash flow budget reduced.

2 – Computer data security issues and identity theft issues will continue to grow.

With more and more business, government, and consumer activities being done online, the need for more sophisticated computer security protection will become critical to protect a company’s and their customers’ information. Backing up data files in the cloud in a remote location, double encryption of data will be necessary, stronger firewalls and virtual private networks for working online will be critical to keep hackers at bay.

3 – Consumers will change their methods of spending, banking and electronic communications.

Identity theft protection will be used by more individuals along with VPNs (Virtual Private Networks) for shopping, and email accounts that offer identity protection like Hushmail will predominate. Financial institutions will have to offer 2-factor identification to log on to accounts or approve credit card transactions that is much more secure than simple security questions. Consumers will freeze their credit and only when they want to apply for credit will they unfreeze it for 24 to 72 hours. Debit cards will become obsolete and credit cards or online paying through platforms like PayPal will be favored, as debit cards offer no financial protection from banks in identity theft hacks. Websites with no SSL security protection will be avoided; this means that if your business or personal website does not begin with htpps:// customers are likely to move on to a website selling the same thing that does have an SSL layer of protection.

4 – The availability of business credit will remain tight.

Despite the government’s insistence that the banking and credit industries loosen lending to businesses so that they can survive, expand, and help create jobs, business credit will remain tight. The financial industries are working to improve profits and keep stockholders happy with little to no regard for lending to small businesses with any change of defaulting and / or filing for bankruptcy. Banks would rather hoard cash and only lend to larger companies that have excellent cash flow and lots of assets; they will remain very reluctant to lend otherwise. Therefore, businesses will need to learn to operate within their income means, rely less on using credit and include cutting expenses to operate within a smaller budget. Reducing debt and raising profits will be a priority.

5 – Businesses will alter product and service lines and add automation wherever possible to survive and grow their companies.

With the current state of the economy, and trade with China iffy, businesses will abandon unprofitable products and services and constantly search out new products and service lines that are very profitable in order to survive and expand. Some brick & mortar stores and chains of stores locations will be closed to enhance the profitability of the remaining locations, and some businesses will move to being totally an online business. The traditional business models will be revamped to include new offerings, local deliver, drive-through or curbside pickup, faster delivery and abundant value for the price to keep customer loyalty and cash flow coming in. Shoppers know they have a choice and will go elsewhere for a better perceived value for the dollars they spend or where they can get better customer service or a price guarantee. New products and services that utilize new technologies, like 5G, will proliferate the market.

6 – Internet Advertising will become more intrusive

While internet advertising will remain a must-do marketing tool in the coming decade, consumers who are tired of having their computer screens littered with ads will use online ad blockers to reduce ads on sites they visit, but the online giants like Google and Yahoo will continue to control the internet space and use it 24/7 to sell display ads which is a huge part of their revenue.

Video advertising and social media platform advertising will continue to grow in popularity. Peer referrals for products and online reviews of products will become more important to consumers before they make buying decisions. traditional mail and print marketing will continue to be used by companies that have large advertising budgets for both primary contact and secondary follow up mechanism to the prospect and/or customer, especially for those physical retail stores who get physical customer traffic for sales. However, savvy consumers will opt out of receiving offers for financial products such as credit cards and things like insurance to protect themselves from scams. Locking mailboxes for single family home residences will become much more popular.

I recommend you get an analysis of the strength of your internet marketing presence and free tips on how to attract more new customers at Customer Finder Marketing.

7 – Word of mouth referrals will remain the gold standard in marketing.

While Consumers already favor getting information online by using their computers, mobile phones or other Internet-based applications for this purpose where they can read reviews, they will still ask family members, friends, and business colleagues for recommendations. More businesses will use both referral incentives and loyalty point program mechanisms to keep consumers coming back to shop.

8 –Mobile phone and computer apps and mobile-phone-ready websites will be a critical component of doing business online.

There are millions of businesses with applications available for mobile phones so consumers can do shopping, banking, stock trades, pay bills, order groceries, make restaurant reservations, schedule vacation packages, and run searches for whatever they want to buy. Websites that are not mobile friendly and apps that do not work seamlessly will be abandoned by consumers.

9 – More entrepreneurs will open small businesses and utilize more independent contractors rather than employees.

To avoid the time consuming and expensive practice of hiring traditional employees and access more talented people in remote locations, new businesses will look for qualified independent contractors to work for them for quantified periods of time on specific projects. Qualified entrepreneurs with specific high-quality talents will desire a flexible work schedule and no limits on what they can make in revenue. Unemployment will continue to be a huge issue and more individuals who can start their own businesses will not want to be locked into the unemployment game. Cash flow plans will include more outsourcing through other businesses instead of internal job creation.

10 – Business owners will remain uncertain about the stability of the overall economy and will stash away cash as a safety net.

Savvy business owners are fully aware of how the political agendas of the day and the government ‘s bureaucratic machine can negatively affect overall business and specific industry in their state or in the country as a whole. They know politicians who have never owned a business, managed employees in a business, or managed the bottom-line profits of a company are ignorant of how their laws and regulations affect a company and its financial health. They will stash more cash for emergencies as they are horrified at the idea that government can demand they shut down their business on the say-so of bureaucrats in Washington DC or by their state government.

Small business owners are worried about the new requirements of the health care regulations due to the COVID-19 pandemic, about not being able to get a loan, about not having enough cash to make payroll and having to lay off valuable workers, about the rising costs of doing business, about prices rising while consumers are unemployed, about slowing demand for their products, and beneath all that is a fear of higher taxes to come if the election goes a certain way. The cash flow budgets of smart business owners will likely include less business travel, and more video and teleconferencing will be used instead to conduct meetings. The stashing of extra cash from those savings will be a priority. This will continue to have a negative cash flow effect on the travel agency, airline, hotel, and rental car industries and some industries will see closures, bankruptcies and loan defaults.

More businesses and possibly whole industries will attempt to move toward commission-based pay for performance instead of standard hourly wages for employees, they will shorten work hours and use more part-time staff to avoid overtime pay. Better, results-oriented worker performance will be required or all employees, assisted with automation wherever possible and computer programs to track results and make corrections quickly and efficiently.

Business will continue morphing into fast, “lean and mean” streamlined operations ready to quickly initiate changes to remain competitive and keep the cash flow rolling in. It will be interesting to be a part of this evolution as we run our own business and help other business owners to win at their cash flow management game.

Here’s to your business cash flow management success in 2020 and on through the rest of the decade!