This question I received from one of my cash flow management software users about the best tactics to pay off debt on multiple credit cards is one that many business owners are asking about, so let’s talk about that.

Question asked: I have both business and personal credit cards that I want to pay off. What is the best way to go about it?

Answer: The first thing to do is to make two separate strategic plans for paying off the credit cards; one for the business cards that thebusiness needs to pay off, and one for the personal cards that YOU need to pay off using what the business pays you for working in and on your business. You need to pay yourself an adequate salary to fund your household budget and pay off those personal cards.

That said, let’s talk about how you can figure out what tactics to use to pay off both sets of cards. Some debt reduction businesses are talking about GPS software systems, so here’s a question…

What can a GPS software system do to help a person get out of debt?

GPS software systems, typically used for navigation, do not directly assist in managing personal finances or getting out of debt. However, using a GPS-like approach can be applied to financial situations to help someone get out of debt. Here’s how you can conceptualize it:

- Set Financial Goals: Typically you set a destination in a GPS system, so in terms of paying off debt you need to set a clear, and achievable, financial goal to do that.

The best way I know of to state a clear goal is:

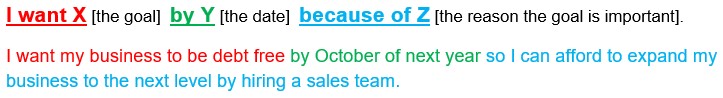

I want X [the goal] by Y [the date] because of Z [the reason the goal is important].

I want my business to be debt free by October of next year so I can afford to expand my business to the next level by hiring a sales team.

- Create a Budget: Think of a budget designed to pay off the debt as your route map. It helps you plan your expenses and income, ensuring you are on the right path to meet your financial goals.<br>

- Track Your Spending: Just like a GPS tracks your progress on a trip, you need to watch your spending habits. This can help you identify areas where you can cut costs [like dining out less often or having business meetings on Zoom rather than at a restaurant] and save more money to pay off your debts faster.

- Work Out Your Debt Repayment Plan: Develop a debt repayment plan that ranks high-interest debts as the first to pay off. There are online and downloadable tools that can help you simulate different repayment tactics that can figure out the fastest and most efficient way to get out of debt.

- Emergency Fund: Having an emergency cash fund is like having a backup route on your GPS. It provides a financial safety net during unexpected events so you don’t have to rely on credit cards or loans and you stay on track to reach your goal of being debt free.

- Increase Your Income: Finding ways to increase your income, such as strengthening your referral network or setting up an affiliate program for your products or services, can decrease the time it takes to get to your goal by helping you pay the debt off faster.

- Credit Score Monitoring: Your credit score is an indicator of your financial health. Monitoring it regularly is like checking your GPS or the WAZE app for traffic updates. A good credit score can provide access to better financial opportunities and lower interest rate cards to transfer balances to

- Financial Education: Educate yourself about cash flow management, both business and personal. Understanding the principles of budgeting, planning, analyzing, allocating, saving, investing, and managing debt is like always having a currently updated GPS system to make sure you’re equipped with the right knowledge to make informed financial decisions.

Getting out of debt is a gradual process that requires discipline and patience. Utilizing these principles to guide you on your journey to be debt-free, can strengthen your financial stability and help you reach your goal.

What tools and software can help you simulate different repayment scenarios?

There are several tools and software programs are available that can help you simulate different debt repayment scenarios like paying off high interest rate cards first, or paying off lower balance cards and then using the payment amount you were paying on that card to add to the payments you were making on the next lowest balance card. These tools are valuable for creating a personalized repayment plan tailored to your financial situation. Here are some of the popular ones:

- Unbury.me: https://unbury.me/ Unbury.me is a simple and user-friendly online tool that allows you to compare different debt repayment methods, including the avalanche method (paying off high-interest debts first) and the snowball method (paying off the smallest debts first). It provides a visual representation of your debt-free journey based on your chosen strategy.

- Credit Karma Debt Repayment Calculator: Credit Karma offers a debt repayment calculator that allows you to input your debts, interest rates, and monthly payments. It then calculates the time and interest you can save by making additional payments. Credit Karma also provides recommendations on how to pay off your debts faster.

- NerdWallet Debt Payoff Calculator: NerdWallet’s debt payoff calculator helps you create a customized debt repayment plan. You can enter your debts, interest rates, and monthly payments to see how different payment strategies impact your repayment timeline. The tool provides valuable insights into the total interest paid and the potential savings.

- ReadyForZero: ReadyForZero is a comprehensive online tool that helps you manage and pay off your debts. It allows you to link your accounts, track your debts, and create a personalized repayment plan. The tool provides insights into your progress and offers strategies to accelerate your debt payoff.

- Debt Analyzer Tools in Personal Finance Software: Many personal finance software programs like Quicken and YNAB (You Need A Budget) come with built-in debt analyzer tools. These tools allow you to input your debts and create repayment scenarios based on different strategies. They often provide real-time updates as you make payments, helping you stay on track.

When using any tool, be sure to input accurate and up-to-date information about your debts, interest rates, and monthly payments. Review your progress on a regular basis and adjust your repayment plan as your financial situation changes. While these type of tools are designed to assist you in making informed decisions, your commitment and consistency in following the plan are key to successfully reaching your goal of being debt-free.

What templates are available online that can help create your own debt repayment calculator using spreadsheet software?

If you prefer the DIY [Do It Yourself] method of doing things, there are templates available online that can help you create your own personalized debt repayment calculator using spreadsheet software like Microsoft Excel or Google Sheets. specific needs. Here are some places online where you can find templates that can serve as a starting point for building your own personalized calculator:

- Microsoft Excel Templates:

– Microsoft’s Template Gallery: Microsoft offers a variety of templates, including debt repayment calculators. You can visit the official Excel template gallery and search for “debt repayment calculator” to find suitable options.

– Vertex42: Vertex42 provides a collection of Excel templates, including debt reduction calculators. Visit the Vertex42 website and search for “debt reduction calculator” to find downloadable templates. Here’s one that has a feature where you can enter your debt information and then switch between the “Debt Snowball” strategy and the “Debt Avalanche” strategy https://www.vertex42.com/Calculators/debt-reduction-calculator.html

- Google Sheets Templates:

– Google’s Template Gallery: Google Sheets also has a template gallery where you can find various financial templates. Open Google Sheets, go to Template Gallery, and search for “debt repayment calculator” to find templates you can use or customize.

– Smartsheet Template Gallery: Smartsheet offers a collection of templates, including debt payoff calculators. You can visit their website and search for “debt payoff” to find templates compatible with Google Sheets.

-

Online Communities and Forums:

– Websites like Reddit (specifically, the r/personalfinance or r/excel subreddits) often have community-contributed templates. Users share their custom debt repayment calculators, which you can download and modify to suit your requirements.

- Personal Finance Blogs and Websites:

– Many personal finance bloggers and websites offer free downloadable templates and tools. Look for reputable personal finance blogs and check their resource sections for debt repayment calculators or similar tools.

When using online or downloadable templates, be sure you check the formulas and calculations to ensure they align with your specific financial goals and strategy. It is also a good idea to customize the template based on your specific debts, interest rates, and payment schedule for the most accurate results.

CAUTION: Be very cautious when you are downloading files from the internet. Make sure you’re using a reputable source to avoid potential security risks.

Finally, use your Cash Flow Mojo® software Cash Flow Control window to allocate weekly to your debt repayment strategy!