Is Your Business Suffering From Too Little Cash Flow, Too Much Debt, And No Money In Savings?

I rescue businesses like yours with my cash flow management software and coaching, so that you can increase your income and profits, pay off the debt and get money into savings for emergencies, business expansion and your retirement.

Yes! I want the

30-Day Trial for $9.99

Improve Your Bottom Line Profits with Business Cash Flow Software

As a business, you need to pay particular attention to how your bottom line is performing. These days, it is easy for a business to fall behind on payments and build up debt, but with a smart cash flow management software solution, you can start to get ahead. Cash Flow Mojo is an intuitive business cash flow management solution that is helping businesses to increase their revenue, reduce debt, and improve their profits. We use smart budgeting, income planning, promotional planning to calculate ROI and our spendable cash flow allocation formula to quickly get your business into a better financial condition.

Solutions for Small Business Cash Flow Management

Small businesses can be particularly sensitive to the way the markets change, so finding yourself behind on bills can be a common occurrence. Cash Flow Mojo was designed as business cashflow planning and management tool with a difference: to help businesses increase their income and become more profitable. With our software, you can quickly and easily get in control of your cash flow and even save for emergencies, business expansion and wealth building programs.

Stay Ahead with Business Cash Flow Management Solutions

Cash Flow Mojo has it all when it comes to business cash flow and finance management. Cash Flow Mojo is not like accounting software that only records the past but doesn’t give you a roadmap and guideposts on what to do to improve your company’s financial condition. Our software plans for today and the future on how best to increase your revenue, reduce or eliminate debt, pay past due and current bills, and even set aside money in savings for future expenses while improving profitability. It contains a vast wealth of training and coaching resources that can change the way you think about your business finances; in a good way. Our goal is profitability, and with Cash Flow Mojo, you are perfectly set up to succeed.

Get a 30-Day Trial of our Small Business Cash Flow Software for just $9.99 Today!

Are you struggling with keeping up when it comes to your profits? As a small business, Cash Flow Mojo can help you to overcome the challenges associated with the financial aspects of your business. We are offering a 30-day trial of Cash Flow Mojo for just $9.99, and you’ll get the full suite of software tools and training during the trial period so sign up today! For more information, contact us today by calling us at (239) 331-7055).

What Do We Do?

Services We Offer

Cash Flow Management

Software

You will discover that our Cash Flow Mojo® Software is unlike any other software product on the market.

Cash Flow Management

Coaching

Professional one-on-one cash flow management coaching with private clients is available on a pre-paid basis at an hourly rate in small blocks of hours.

Accounting

Review

A professional accounting review is available for private clients. All accounting reviews are conducted by Sandra Simmons,

About The Software

Here is what is included and what each part of our cash flow management software does for you.

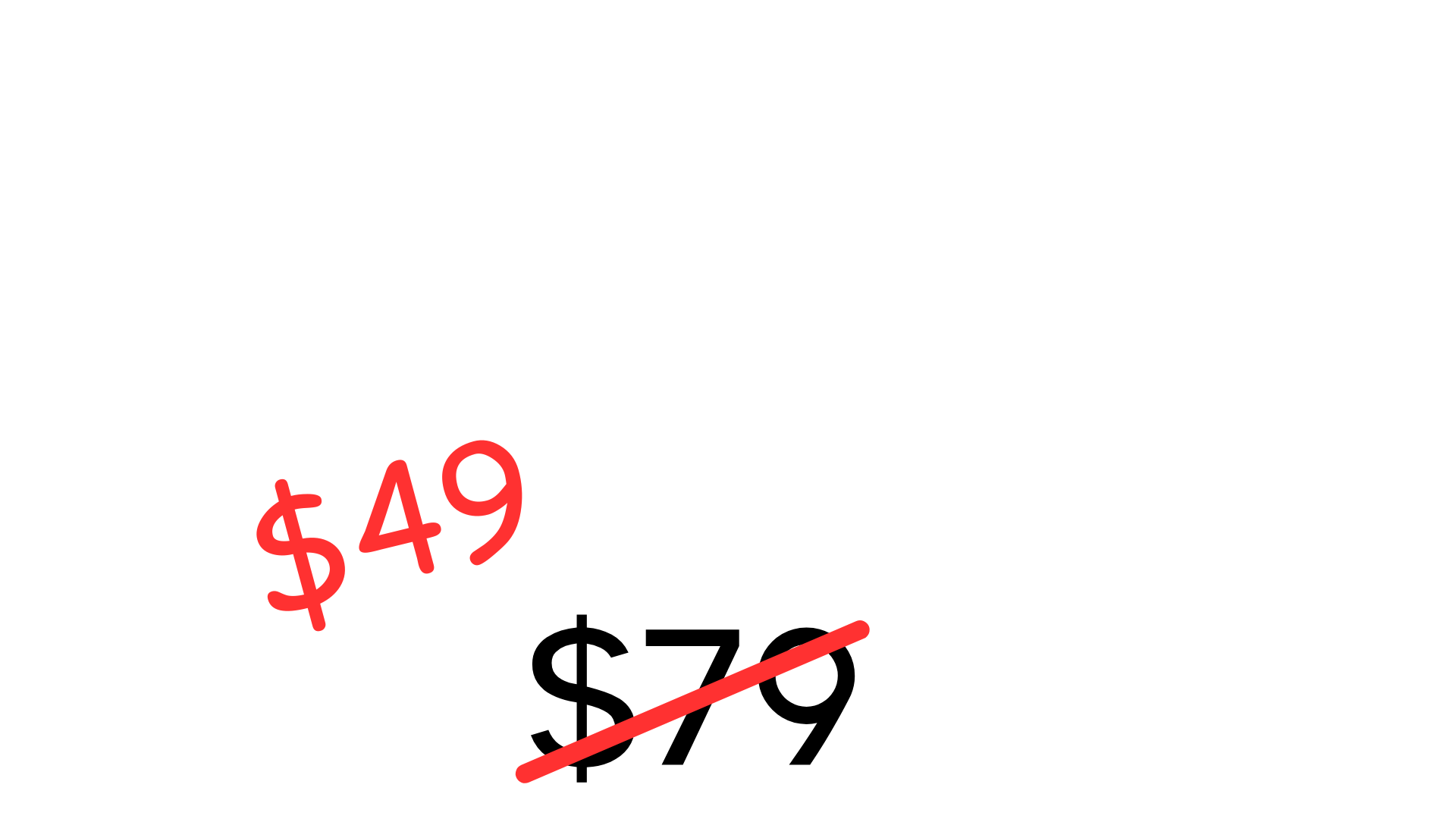

Promotional Pricing Available for A Limited Time Only

MONTHLY

+ Full Access to the Software System

+ Built-In Video Training

+ Full FAQs online

+ Complimentary Group Coaching

ANNUAL

+ Full Access to the Software System

+ Built-In Video Training

+ Full FAQs online

+ Complimentary Group Coaching

Let Us Help You

With Your Business Cash Flow – With Our Software, Training, and Consulting!

Training Tools

Unleash Your Cash Flow Mojo—Book

In this book you will discover that unleashing the cash flow mojo is within the grasp of every business owner who cares to make use of it.

Business Checklist to Increase Profits – Training Workbook

There is a simple science of managing money correctly that increases profits. Very rich people know this science.

About The Company

What If Your Company Was Debt Free, Current On Its Bills With Plenty Of Cash In Savings? – What Would That Be Worth To You?

If you could get a road map on how to get there would you be willing to spend $10 and 30 minutes a week using the map and following the guideposts along the route?

If your answer is “YES!”, then consider what this business owner said about his experience when he signed up for the 30-Day trial of the Cash Flow Mojo Software, used it on a weekly basis, and then continued his monthly subscription.

Client Testimonials

Trusted By Businesses In 34 Countries Around The World

This software and the training are great! It has cleared up a lot of my questions about managing money. I am relieved I can be in control of my finances in an efficient way with a little effort on a weekly basis.

Clyde K. DVM

Finances have been a troublesome area of my life forever – whether I had plenty of money or not I felt a lot of anxiety about money. Thanks to your cash flow management software program and training materials I now know I have a simple, workable tool to use to control my cash flow and stop the worrying!

Allison P. Philadelphia, PA

FREE Cash Flow Control Guide

• Are you wondering how to take charge of your business finances so you have no worries about money?• Are you spending more than you make and going deeper in debt?

It’s A Proven Truth

When you manage your business cash flow correctly, it puts you in control of the financial success of your company.

If you want to know more about cash flow management and how it can help your business, go to this page Cash Flow Management. You will also find the Top Ten Tips on How to Manage Cash Flow on that page.

Client Testimonials

Trusted By Businesses In 34 Countries Around The World

This software and the training are great! It has cleared up a lot of my questions about managing money. I am relieved I can be in control of my finances in an efficient way with a little effort on a weekly basis.

Clyde K. DVM

Finances have been a troublesome area of my life forever – whether I had plenty of money or not I felt a lot of anxiety about money. Thanks to your cash flow management software program and training materials I now know I have a simple, workable tool to use to control my cash flow and stop the worrying!

Allison P. Philadelphia, PA

Blog

Read Our Helpful Blog Posts

How To Pay Off Debt Fast

This question I received from one of my cash flow management software users about the best tactics to pay off debt on multiple credit cards is one that many business owners are asking about, so let’s talk about that. Question asked: I have both business and personal...

8 Factors To Consider Before Choosing A Cash Flow Management Software

Business money management is easy if you have the right cash flow management software. Whether you are working to pay down debt or increase revenue, the right tool is necessary. Here are 8 factors to consider before choosing a business cash flow management software program.

6 Benefits of Good Finance Managing Software

Help your financial team manage your company’s cash flow with the right software. It helps simplify your processes by making it easier to track debts and plan payments. That allows you to determine how much your spendable cash is so that you can allocate it to your...